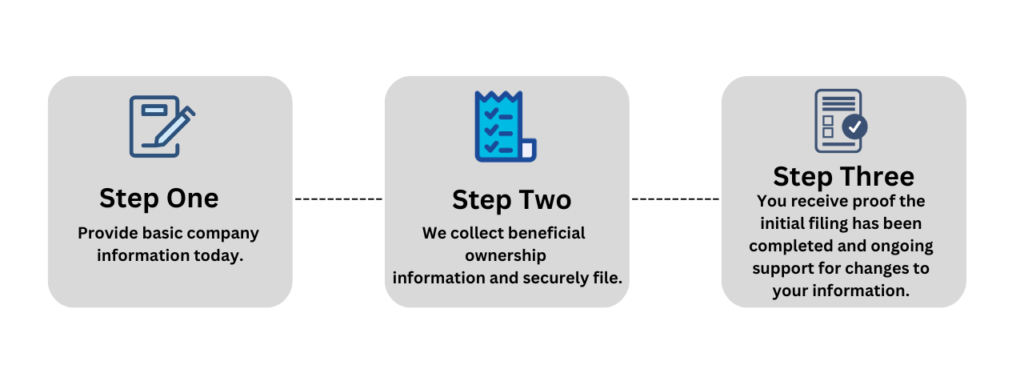

Reporting Beneficial Ownership Information is more than just a one-time filing. As beneficial owners change, companies must complete additional filings to notify FinCEN of the updates. Additionally, information submitted in error must be updated via corrected reports. Unlike the solutions offered by other providers, up to four initial, updated, and corrected reports are included in AVI Business Solutions BOI Reporting Service annually.

Beneficial Information Reporting refers to the process of disclosing the identities of individuals who ultimately own or control a company, often known as “beneficial owners.” This reporting is crucial for transparency and combating financial crimes such as money laundering, terrorist financing, and tax evasion. In the USA, this type of reporting is governed by several key regulations and requirements.

Key Aspects of Beneficial Information Reporting

Refinition of Beneficial Owne

Overview: A beneficial owner is an individual who, directly or indirectly, owns or controls a significant percentage of a company’s shares or voting rights. This also includes individuals who have substantial control over the company’s decisions, policies, or management.

Thresholds: Typically, a beneficial owner is someone who owns 25% or more of the company’s equity or has significant control over the company’s operations.

Financial Crimes Enforcement Network (FinCEN): Under the Corporate Transparency Act (CTA), enacted as part of the National Defense Authorization Act (NDAA) in January 2021, FinCEN requires certain entities to disclose their beneficial owners. The CTA aims to enhance transparency in business ownership to prevent illicit financial activities.

Beneficial Ownership Information (BOI) Reporting: The CTA mandates that companies submit beneficial ownership information to FinCEN, which will maintain a confidential database accessible to law enforcement and certain other authorized entities.

Entities Required: Most corporations, limited liability companies (LLCs), and similar entities must report their beneficial owners. There are some exemptions, such as large operating companies, certain regulated entities, and entities already subject to extensive disclosure requirements.

-Exemptions: Publicly traded companies, banks, credit unions, insurance companies, and entities registered with the SEC are generally exempt from reporting under the CTA.

Details Required: The reporting entities must provide information including the full legal name, date of birth, address, and identification numbers (such as a driver’s license or passport) of each beneficial owner.

Purpose: This information helps authorities trace ownership and control structures, making it easier to detect and prevent financial crimes.

Reporting Deadlines: New companies must file their beneficial ownership information at the time of formation, while existing entities have a set deadline to comply. Updates must be made whenever there are changes in beneficial ownership.

Penalties for Non-Compliance: Failure to report or falsifying information can result in significant penalties, including fines and potential criminal charges.

Enhanced Transparency: Helps create a clearer picture of who controls and benefits from various businesses, reducing the risk of hidden financial activities.

Anti-Money Laundering (AML) Efforts: Supports efforts to prevent money laundering, terrorist financing, and other financial crimes by making it harder for illicit actors to hide behind anonymous shell companies.

Improved Regulatory Oversight: Assists regulators and law enforcement in investigating and enforcing financial regulations.

Data Protection: While beneficial ownership information is reported to FinCEN, it is not publicly accessible. Access to this data is restricted to law enforcement agencies, financial institutions, and other authorized entities involved in legal or regulatory proceedings.

In Summary:

Beneficial Information Reporting is a critical measure to promote financial transparency and combat illicit financial activities. By requiring companies to disclose their beneficial owners, the USA aims to strengthen its financial system’s integrity and support effective law enforcement and regulatory actions. Ensuring compliance with these reporting requirements helps safeguard the financial sector from misuse and enhances overall corporate transparency.